Shopping behaviour in 2023: A review

At Tabby, we want to help retailers make the best decisions possible by opening up access to one of the richest sources of shopping data in the Middle East.

We will analyse 2023 Tabby's sales data to answer two key questions.

- When did shoppers buy?

- How did shoppers buy?

Reflecting on these questions will give us valuable insights that might influence your 2024 retail strategy.

Finding out when and how shoppers buy is helpful when creating a retail strategy. It shows us the best time to invest in advertising campaigns, hire extra staff, release new products and post on social media.

This article is designed to help you sell more next year, so have through our data and compare it with your own to reach some actionable insights.

When did shoppers buy?

Yearly

In the UAE, the year has two clear sales seasons, Ramadan in early April and Black Friday in November. Statistically, the dip in May following Ramadan is the poorest month for sales. In Saudi Arabia, it is a slightly different story; you can see from the graph that Black Friday does not carry the same significance. Instead, sales peak dramatically for Ramadan and then repeat cyclically with lower and lower peaks until a slight uplift at the end of the year.

Monthly

On a month-by-month basis, it’s clear that the sales peak is driven by payday on the 27th. The decrease after the 27th in the UAE is slightly more gradual than in KSA, with a 17.9% increase in sales value in 3 days.

The second peak in Saudi Arabia is due to some companies paying twice a month, with the second payday falling on the 10th.

Although there is still a clear peak around payday. Buy now, pay, later services help shoppers spread their purchases more evenly over the month. Look at your own data to see how your sales from other channels compares.

Weekly

We can see from the graph that Friday has the lowest sales weekly. As well as Friday having religious significance, it’s also possible that for businesses such as restaurants and cinemas, Friday is a peak day. These are industries that buy now and pay later are not so widely used.

Sunday is the highest day for sales, perhaps led by shoppers having time to browse for new purchases at the start of the week. Interestingly, Tabby's social media data shows the highest usage on a Sunday. This could influence sales either because it means customers are already on their phones, but they also get influenced by digital advertising and influencers into making a purchase.

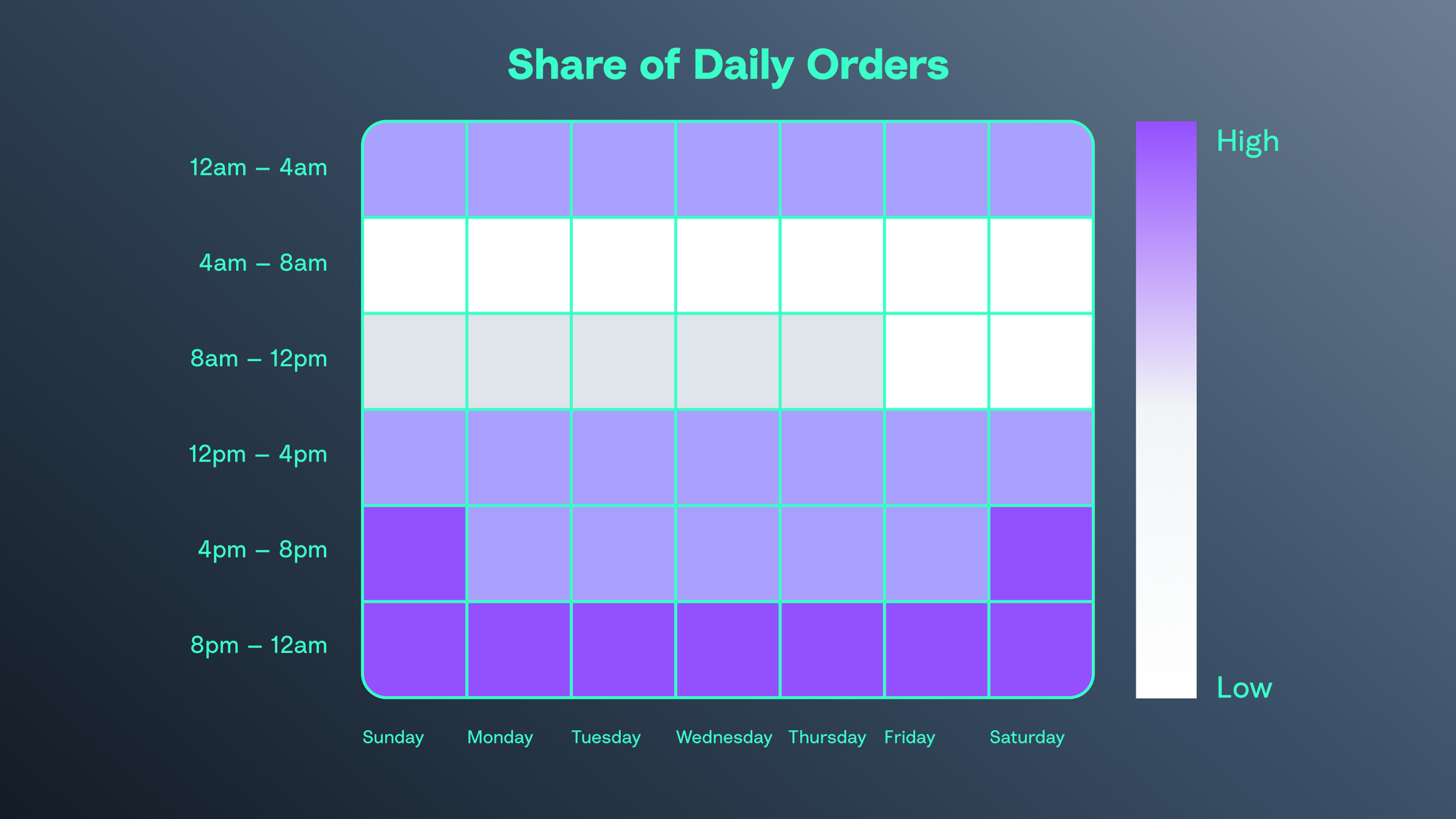

Sales on an hour-by-hour basis are fairly consistent over the seven-day week. Daily sales are lower in the early morning and increase steadily until peaking in the evening at 8 pm-12 am.

The most popular time for shoppers to make a purchase is on Sunday evening, and the least popular time to make a purchase is Friday morning.

Although this is an average over 2023, other factors such as payday, national holidays, and sales seasons can greatly influence weekly results.

How did shoppers buy?

As you can see, in terms of sales value, online was significantly higher than in-store during 2023.

However, when we look at the trend over the last six months, it tells a different story.

The increase in Tabby's in-store purchases signifies a solid trend towards shoppers using flexible payments, an increasing amount in-store instead of exclusively online.

We can see this in the following chart. Nearly 20% of all Tabby shoppers now use Pay in 4 online and in-store. We anticipate this only increasing in 2024 as shoppers seek payment consistency across channels.